News: Markets

30 November 2021

UV LED market to grow to $2.466bn in 2026, driven by impact of COVID-19

The UV lighting market is expected to rise at a compound annual growth rate (CAGR) of 17.8% from 2021-to $3.5bn in 2026, with the UV LED market in particular growing to $2.466bn, forecasts market analyst firm Yole Développement in its new report ‘UV LEDs and UV Lamps – Market and Technology Trends 2021’.

The UV lighting market overall was about $400m in 2008. By 2015 UV LEDs alone were worth $100m. In 2019, the total market reached $1bn as UV LEDs spread into UV curing and disinfection. The COVID-19 pandemic then drove demand, increasing total revenue by 30% in just one year. Yole hence expects the UV lighting market to be $1.5bn in 2021 before rising at a 17.8% CAGR, doubling or tripling to $3.5bn in 2026.

“The COVID-19 pandemic has created some perfect use-cases for UV lighting technologies to spread throughout a rapidly changing disinfection market,” says Pars Mukish, business unit manager, Solid-State Lighting & Display, at Yole.

Indeed, SARS-COV-2, the virus that causes COVID-19, has one of the highest reproduction/transmissibility rates among all viruses that have emerged. To reduce the spread of the disease, light in the UVC wavelength band (which can deactivate bacteria and viruses through physical methods) has gained unprecedented attention. Overall, there will be a ‘before’ and an ‘after’ the COVID-19 pandemic for the UV lighting industry, says Yole.

“Indeed, the health crisis due to the SARS-CoV-2 virus has generated unprecedented demand for the design and manufacture of disinfection systems using optical UV rays,” notes Joël Thomé, CEO of photonics innovation services provider PISEO (a partner of Yole), which has released the report ‘UV-C LEDs in the Time of COVID-19 - Update November 2021’. “LED manufacturers have seized this opportunity, and we are currently seeing an explosion in UV-C LED products.”

The COVID-19 pandemic has strongly impacted the UV industry in general, notes the report ‘UV LEDs and UV Lamps – Market and Technology Trends 2021’. On the one hand UV lamps are historic, established and mature technologies in the UV lighting market. Business before the COVID-19 pandemic was driven mostly by polymer curing with UVA wavelength light and water disinfection with UVC light. On the other hand, UV LED technologies are still emerging. Until recently, business was mostly driven by UVA LEDs. It was only a few years ago that UVC LEDs reached the performance and cost specifications of early adopters and started generating revenue.

“Both technologies will benefit, but on different timelines,” says Pierrick Boulay, senior technology & market analyst, Solid-state Lighting, at Yole. “In the very short term, UV lamps might dominate end-systems because they are already established and easy to integrate. However, this proliferation of applications is a catalyst for the UV LED industry that will further push the technology and its performance forward. In the middle-to-long term, several end-systems might further adopt UV LED technology”.

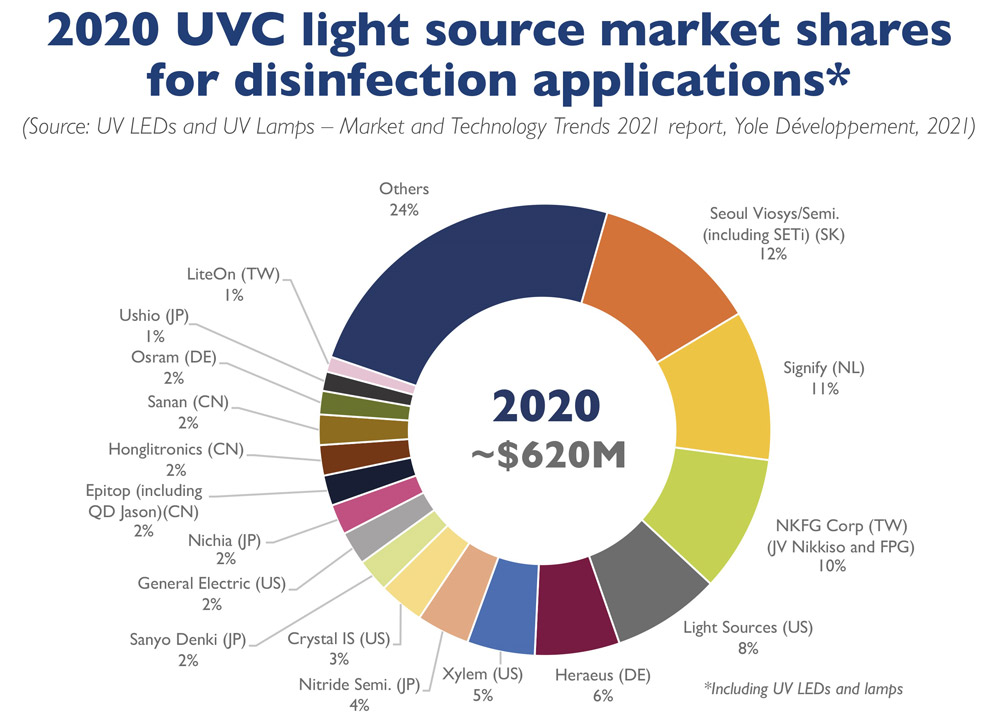

Numerous industries and players supply UV lamps and UV LEDs. Signify, Light Sources, Heraeus and Xylem/Wedeco are the top four UVC lamp players, while Seoul Viosys and NKFG are currently leading the UVC LED industry. There are few overlaps between the two industries. Yole expects this to remain the case even though some UVC lamp players, such as Stanley and Osram, are diversifying their activities into the UVC LED field. In total, PISEO has identified 15 more UV-C LED manufacturers compared with 2020.

Overall, the UVC LED industry is likely to be the most transformed by recent trends. The industry has waited more than 10 years for this moment to happen. All the players are now ready to grab a piece of this booming market, says Yole.

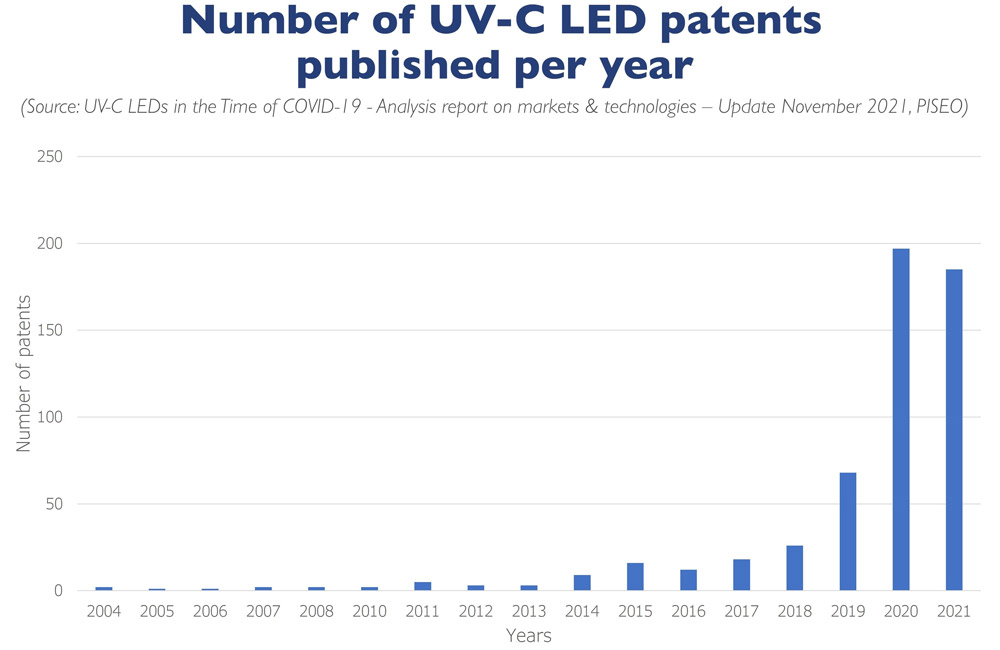

UV-C LED-related patents

The number of UV-C LED-related patents filed in the last two years has exploded, illustrating the dynamism of research in this area, states PISEO. In its new UV-C LED report, PISEO offers a particular focus on the key patents of four LED makers, highlighting the main challenges of the rollout of this technology: intrinsic efficacy and cost. Yole also offers a complementary analysis of the patent landscape. The need for disinfection and the opportunity to use small light sources enabled the creation of increasingly compact systems. This evolution, including new form factors, has clearly generated renewed interest on the part of LED makers.

Wavelength is also a key parameter for germicidal efficiency and optical risk assessment. “Although currently relatively scarce and expensive, several system manufacturers, such as Signify and Acuity Brands, are taking a close interest in sources emitting a 222nm wavelength due to the harmlessness of this optical radiation on the human body,” notes Matthieu Verstraete, Innovation Leader and Electronics & Software Architect at PISEO. Several products have already been placed on the market, and there are more to come that integrate excimer sources made by the company Ushio. PISEO’s specialists therefore review the state of medical research, the technology of sources emitting at 222nm, the germicidal effect of this wavelength, the regulatory environment, and the roadmaps produced.

UV LEDs and coronavirus: how effective are the latest sanitizer systems?